What You Need To Know About Filing Bankruptcy In Texas

If you're considering filing for bankruptcy in Texas, here are a few things you should know about Texas bankruptcy law.

Three aspects of Texas law significantly affect bankruptcy. The first is the unlimited Homestead exemption; the second is that it offers a $50,000 personal property exemption. And lastly, the fact that Texas does not allow wage garnishment for routine consumer debts.

Each of these aspects sets Texas apart from other states regarding bankruptcy.

Finally, if your income is above the Texas median, your housing expenses come into play when it comes time to complete the means test.

The expense allowances for housing vary widely from county to county in Texas. So, the housing allowance you get in McKinney, Texas is 5x larger than you get if you live in Stonewall County.

We're here to help you navigate these layers of federal, state, and local rules that come into play when you file bankruptcy in Dallas, TX.

LegalConsumer.com's "Bankruptcy By Zip Code" website has provided free, local bankruptcy information to more than 10 million consumers since 2006! Let us help you learn how bankruptcy works in Dallas, TX.

How to File

- Chapter 7: How does Chapter 7 bankruptcy work in Texas?

- Chapter 13: How does Chapter 13 bankruptcy work in Dallas, TX?

Means Test

- Free Means Test Calculator: Are you eligible for Chapter 7? This calculator will help you find out. Online since 2006. Updated with May 2023 income & expense standards.

- Local Standards: Texas and Dallas County: Every state and county is different.

- Texas Median Income: Each state has its own Median Income standard.

- Expense Standards For Dallas County: Each county has its own standards for housing expenses.

- Line by Line Help: Just the bits you need when needed.

Bankruptcy Court

- Which court do I use? Bankruptcy is a federal law, so you use a Federal Court.

- Where do I file for bankruptcy?

- Can I file Electronically? A few courts are now allowing debtors to file electronically. Also, services like Upsolve.org can help.

- Court Info For Non-Attorneys: Every court offers guidance for debtors who don't have an attorney. Some courts more than others.

- Who is the Trustee? Learn about the court person you'll deal with if you file. It won't be the judge.

-

Forms & Instructions

- Downloads: Where can I download free bankruptcy forms for my court?

- Which Forms? You don't need them all. We'll tell you which ones you need.

Exemptions

- Schedule C: The form where you claim your property as exempt.

- Federal Bankruptcy (§522) Exemptions: Some states allow you to use the Federal Bankruptcy Exemptions listed in 11 USC § 522. The remaining states have "opted out" and only allow you to use the state law exemptions.

- Texas Exemptions

- Real Estate

- Your Home (Homestead Exemption): Almost every state (48) has a homestead exemption.

- Personal Property:

- Car/Truck/Van: Most states explicitly exempt motor vehicles. In some states, it's pretty generous.

- Tools of Your Trade: From delivery vans to shop tools, most states allow you to exempt tools you use for your work, up to a certain amount.

- Other

- Financial Accounts & Cash

- Retirement Accounts & Pensions: You can protect over $1M in retirement accounts if you file for bankruptcy.

- Public Benefits: States differ as to what benefits you can keep.

- Bank Accounts: Once you deposit exempt funds in a bank account and mix them with non-exempt funds, you risk losing them unless you take extra steps to trace them and claim them as exempt.

Types of Debt

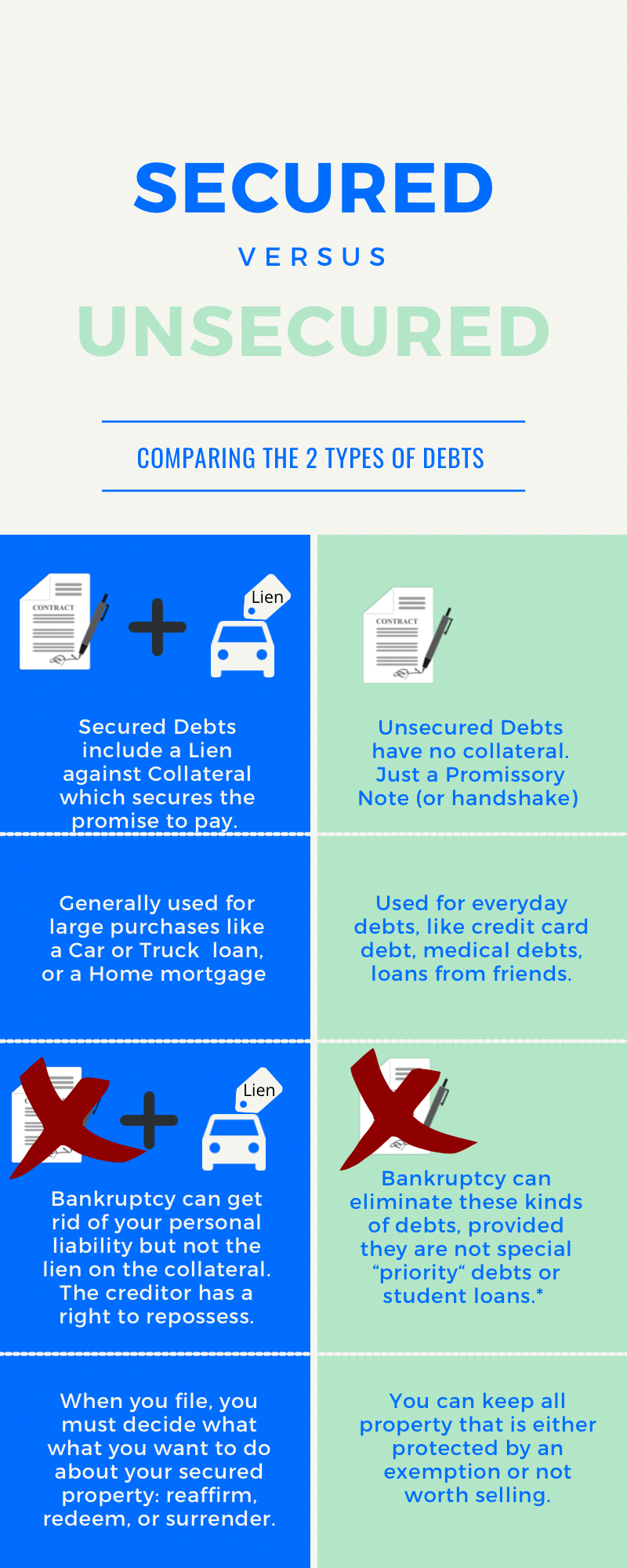

- Secured Debts: Bankruptcy doesn't get rid of secured debts, but in some cases, it can greatly reduce them. When you file, you'll be asked what you plan to do about your secured debts. Your options are: -

- Surrender: Give back the property and wipe out any remaining deficiency balance in bankruptcy.

- Redeem: - Come up with the cash to buy the property outright at its current value..

- Reaffirm: - Keep the arrangement you have, and leave this debt unaffected by your bankruptcy.

- Common Types of Secured Debts:

- Mortgages

- Car Loans

- Judgement Liens:

- How to "void" them on exempt property.

- Unsecured Debts: Most unsecured debts, like credit cards and medical debts, can be discharged in bankruptcy.

- Credit Card Debt

- Medical Debt

- Personal Loans

- Payday loans

- Unsecured Debts that require extra steps:

- Student Loans: Extra steps required to get rid of it

- Undue Hardship: What do you have to prove to get a discharge?

- Adversary Proceeding: Like a mini-trial within your bankruptcy case.

- Student Loans: Extra steps required to get rid of it

Lawyers Near Me

- How can I find a good local bankruptcy lawyer near me?

- What should I expect from a bankruptcy attorney?

DIY Solutions

- UpSolve: Upsolve is a new way to file for bankruptcy that is well-suited to debtors with little or no property.

- SoloSuit: If you've been sued for debt, SoloSuit can help you stave off a wage garnishment.

Note: This website is updated as time permits. It is up to you to contact your local court and confirm and update any information you need. Information is not advice. See a bankruptcy lawyer for advice about how the law relates to your situation.